Fuel

duty increase fudge in Budget on 8th July 2015?

A

headline of a news item in today's Sunday Times says "Osborne’s fuel

tax ‘fudge’ to give Treasury £4bn fill-up".

The item speculates on whether the Chancellor may reinstate inflationary rises

in fuel duty in his early Budget on 8th July whilst arguing he has frozen fuel

duty in real terms though clearly not in cash terms.

See

our series of Budget reports

Posted: 150607

|  | As

we have seen from the regular Budget reports on the V8 website the Chancellor,

George Osborne, has frozen fuel duty on petrol and diesel at 57.95p a litre for

more than four years by repeatedly cancelling the increases planned by the previous

Labour administration. That was the longest fuel duty freeze in 20 years. The

combined effect of that fuel duty freeze has been most welcome for motorists,

particularly when crude oil prices and hence motor fuel prices have been high,

but whilst over the last six months or so crude oil prices have fallen substantially

there has been a modest recovery lately. The Chancellor is now working on his

first "early Budget" of the new administration period following the

General Election in May and with his commitments to freeze many taxes inevitably

he is looking at other areas where tax revenues can be generated.

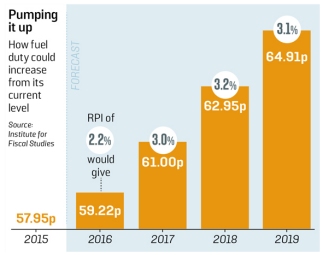

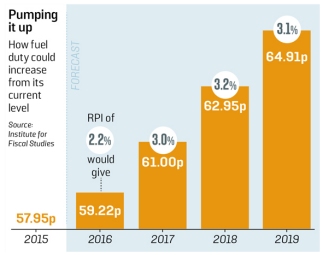

The Sunday

Times' article

suggests reintroducing inflation | rises

on fuel duty would see the duty rise by 12% to 64.91p a litre by 2019-20 according

to inflation forecasts from the Government's Office for Budget Responsibility.

The Institute of Fiscal Studies calculates that this would add almost £5

to an average 50 litre fuel tank once VAT is added on top and raise an estimated

£4.1bn of tax derived income for the Treasury by the end of the decade than

by keeping fuel duty at the present level.

The article ends with the classic

report that "the Treasury refused to be drawn on the prospect of tax increases

saying only "We're not commenting on budget speculation"." |

|