Update

Sir Kier Starmer has opened the door to a rise in fuel duty in the

Autumn Budget set for Wednesday 30th October

See our briefing on the Autumn Budget 2024.

That includes an update released on 10th August 2024. Briefing

Acknowledgement: Daily Telegraph

Update: 240912

Posted: 240829 |

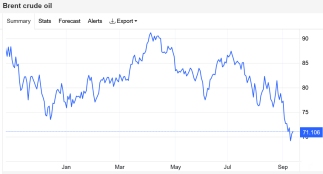

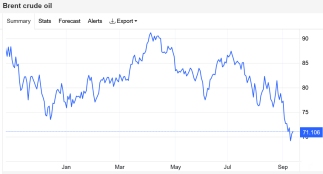

Oil

prices at lowest level since 2021 - but will motorists benefit?

|

The

recent easing in pump costs may encourage the the Chancellor

to reverse the last government's 5p-a-litre fuel duty cut, with

little obvious pain, in the looming Autumn Budget. A slump in

crude oil prices could lead to further reductions at the fuel

pumps but any benefit risks being stripped away next month as

the Chancellor of Exchequer seeks ways to bolster the public

finances. A

barrel of Brent crude, the international benchmark, slipped

below US$70 for the first time since December 2021 on

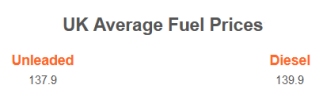

Tuesday afternoon. Chart

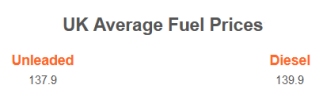

Fuel price report from PetrolPrices.com alongside. Prices

are at a welcome low level.

www.petrolprices.com

|

|

The

headline feature in the DailyTelegraph today says "fuel

duty could be next in tax grab". It reports "Sir

Kier Starmer has opened the door to a rise in fuel duty in the

Autumn Budget set for Wednesday 30th October. Despite his

pledge not to increase taxes on working people, the Prime Minister

suggested an increase in the fuel duty, paid by millions of

motorists in the UK, was on the table". That would reverse

a 14-year period under the Conservatives with no fuel duty increases.

The levy stands at 52.95p a litre after a temporary reduction

of 5p was brought in by Rishi Sunak in March 2022 when he was

chancellor in the wake of the invasion of Ukraine. This level

of fuel duty was maintained in subsequent Conservative budgets. |

End

of the fuel duty freeze?

The fuel duty freeze could now be vulnerable to the new Chancellor's

need to raise money. "When asked if he acknowledged that

a rise in fuel duty would be a tax on working people, and whether

he would reject it, he told reporters yesterday: "Well

look. Firstly, we made very clear pledges before the election

in relation to tax on working people. You heard it a number

of times in relation to income tax, VAT and National Insurance

and we absolutely stick to that - beyond that I am not going

to speculate about the (forthcoming) Budget.""

Edmund

King, the president of the AA, said "any hike in fuel duty

would backfire by increasing inflation and hitting those in

rural areas who have no alternative to cars". He added

"the Government benefits from increased VAT income as well

as fuel duty". This is because VAT is charged on the total

cost of fuel and fuel duty.

How

much would a 5p hike in fuel duty cost the motorist?

For a daily use car that could be an increase £70 or more

a year, including the addition of VAT on the duty. For MGV8

enthusiasts on a limited mileage of say 2,000 to 3,000 miles

pa they would pay an additional £18 to £27 a year.

Other

tax increases

Yesterday the current Chancellor, Rachel Reeves, refused three

times to rule out raising inheritance tax and capital gains

tax in her first budget. The Treasury would also not rule

out a wealth tax - a key demand of the Unite union. Starmer

warned on Tuesday that "the upcoming Budget would

be painful".

|

|