Car

taxation climb down

In his Pre-Budget Report to the House of Commons on Monday 24th

November 2008 the Chancellor said "turning first to motorists,

we rightly have a system of car taxation which takes into account

the environmental impact from different types of car. In the

last Budget, I announced I was going to take this further by

increasing the number of bands for Vehicle Excise Duty. As planned,

differential first year rates which people pay when they buy

a new car will be introduced in April 2010. They provide powerful

incentives to purchase less polluting cars. I intend to go ahead

with the introduction of new bands, reflecting fuel efficiency.

But it would be wrong to do this in a way that places undue

burdens on motorists at this time. So I have decided to help

people by phasing in new rates and lower increases.

First,

in 2009, duty rates for all cars will only increase by a maximum

of £5 as has been normal practice.

Second,

from 2010, we will bring in differential increases in duty.

In the original proposals, some cars would have seen increases

of up to £90. Instead, I now propose that more polluting

cars will see duty increased, but up to a maximum of £30.

Less polluting cars will see no increase or a cut of up to £30."

|

Limiting

VED increases to £5 in 2009/10

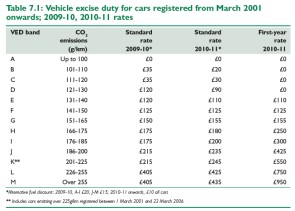

7.34. As a result of these reforms to graduated VED, no driver

in any given band will pay more than £5 extra in 2009.

In 2010-11, when more significant rate changes are introduced,

a majority of drivers will either pay less or the same as in

2009. When the Government introduces First-Year Rates for newly

purchased cars in 2010, new cars under 130 g/km will pay no

VED at all in the first year of use, whereas the very highest

emitting cars will pay £950. The full set of rates is

set out in Table 7.1 below.

For a full size copy of this chart. More

Cars registered before 2001

7.35

Cars registered before 2001 – which account for around

a third of the fleet – are not subject to the graduated

VED regime, because comprehensive data on their carbon dioxide

emissions is not available. In Budget 2008, it was announced

that in 2009 the lower rate of VED for these vehicles would

be frozen and the higher rate would be increased by £15.

In line with the changes to main VED rates, this change will

be postponed for a year, and on 1 April 2009 both rates will

instead increase by £5. These rates will also apply

to light goods vehicles registered before 2001. |