Extract

from the Pre-Budget Report issued on 24th November 2009

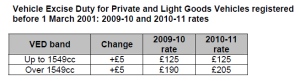

Cars registered before 2001

7.35 Cars registered before 2001 – which account

for around a third of the fleet – are not subject

to the graduated VED regime, because comprehensive data

on their carbon dioxide emissions is not available. In

Budget 2008, it was announced that in 2009 the lower rate

of VED for these vehicles would be frozen and the higher

rate would be increased by £15. In line with the

changes to main VED rates, this change will be postponed

for a year, and on 1 April 2009 both rates will instead

increase by £5. These rates will also apply

to light goods vehicles registered before 2001. |

|

12

month reprieve on previous Vehicle Excise Duty increases for

pre-2001 cars

New Vehicle Excise Duty rates for pre-2001 cars

The VED rates for cars registered before

2001 (most MGBGTV8 and RV8 models will be in this category)

are set out in a table included in a press notices from HM Treasury.

The rates are £190 for 2009/10 and £205 for 2010/11.

For a full size copy of this table. More

|

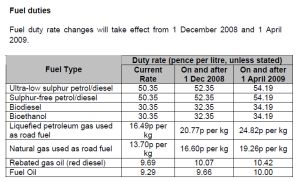

Increases

in fuel duty threatened for October 2008 will now take effect

on 1st December 2008 and

1st April 2009

In an opportunistic move, the Chancellor said "the reduction

in VAT lowers the amount of tax paid on motor fuel. In addition,

petrol prices have come down by 7 pence a litre last month alone.

So I will offset the VAT reduction by increasing the duty by

an amount which should keep the overall cost to consumers the

same this year. Of course, if we see a stronger economy and

increased tax revenues, we will review whether we need to take

these tax raising measures." Well if you believe he would

reduce them you must believe in fairies! |

For

a full size copy of this table. More

|

| So

that is an increase of 2p/litre on 1st December 2008 and a further

1.84p/litre on 1st April 2009 on motor fuel. If petrol prices

were to remain at 92.9p/litre without the extra duty, then these

increases over the next five months would amount to 3.66% or

£57 for a V8 enthusiast doing 10,000 miles pa. |

|