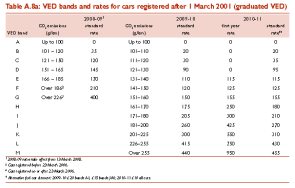

In a V8BB posting this morning Chris Hunt Cooke notes "The mainstream media catch up with the V8BB. We discussed here on 6th April the proposed increase in the higher rates of VED from 2009, with an element of backdating for vehicles registered from 2001 to 2006. The main story in The Times today is on just that point". A stealth tax move in the Budget 2008 affecting motorists was highlighted in a V8BB discussion thread launched by Dr Gavin Bailey on 6th April 2008. He was concerned over what looked like "major implications for cars registered after 28th March 2001". See V8BB thread A report in The Times this morning confirms that "the Treasury admitted to The Times last night that it was quietly abolishing the exemption for older cars from the highest rates of vehicle excise duty. This means that owners of larger cars bought since March 2001 will find that their road tax will rise steeply from next April. The increases are being introduced in two stages, with many owners who are now paying £210 a year being charged £300 in 2009 and up to £455 in 2010". See The Times report Hidden away on page 121 of the Treasury's Financial Statement and Budget Report containing the "Budget Policy Decisions" was Clause A97 and Table A.8a that provided this unwelcome news for owners of cars with high CO2 emissions registered after 1st March 2001 - yes more graduated Vehicle Excise Duty |

proposals. These

will affect V8 members who have registered an MG ZT260V8 or MGSV

after that date and many other vehicles too may have that are

caught by these proposals. Posted: 30.4.08 |

| What

is the likely effect of these graduated VED proposals and the

recent rise in fuel costs? Well in financial terms the value of these cars will fall from a combination of the present value of the stream of future higher VED payments and the stream of additional payments made for fuel which of course will have a higher impact on engines with lower mpg figures like an MGZT260V8. An additional mark-down is likely from the "uncertainty" factor too - what will future graduated VED rates be and where will fuel prices go over the next ten to fifteen years. |

Could

the retrospective feature continue? With the present Government's inclination - even fondness - for introducing taxes by stealth, hoping the public may not spot them and when they do it is far too late to repair the damage, the real concern for V8 enthusiasts is the "retrospective feature" evidenced by the latest tax change. The fear is that might extend further back and catch MG RV8s and even MGBGTV8s. We all recall that one of the first changes the present Prime Minister Gordon Brown, then Chancellor of the Exchequer, made was to freeze the rolling annual 25 year VED exemption on classic cars. So most MGBGTV8s missed out on the concession, many by a matter of months! |

Government spokeswoman admits the VED tax changes was not spelt out in the recent Budget

The Times revealed yesterday that the Treasury had quietly abolished the exemption from higher road-tax rates for cars that emit more than 225g of CO2 per km and were registered between March 2001 and March 2006. Sadly it shows the duplicity of the Government over these VED tax changes. The Times report noted:

The Treasury admitted yesterday [Wednesday] that it had failed to make the tax changes clear in the Budget. A spokeswoman siad: "It's not as clear in the Budget as it could be. It's not explicitly spelt out.". Justine Greening, the Conservative Treasury spokesman, said "This is duplicity from the Treasury who deliberately failed to make any mention of this tax grab at the time of the last Budget. Last year Gordon Brown promised not to backdate the CO2 charge on family cars to before 2006 and now he's broken yet another promise."

Already the values of cars with CO2 emissions of more than 225g/km and low mpg performance in the 2001-2006 bracket are falling from a combination of the increased VED rates and higher fuel prices. The full report on the "Road-tax hike" can be seen on The Times website. See The Times report on 1.5.08. More

Update: 2.5.08